THELOGICALINDIAN - The struggles of cryptocurrency barrier funds in 2026 assume to accept no end in afterimage With bisected of the year about gone these cryptofocused barrier funds abide to accomplish ailing

According to the Financial Times, cryptocurrency barrier funds are bottomward by 35 percent so far in 2018. This abatement is in abrupt adverse to 2017 back revenues grew by 2,700 percent. Such was the success of the bazaar that a absolute of 167 firms were accustomed in 2017 alone.

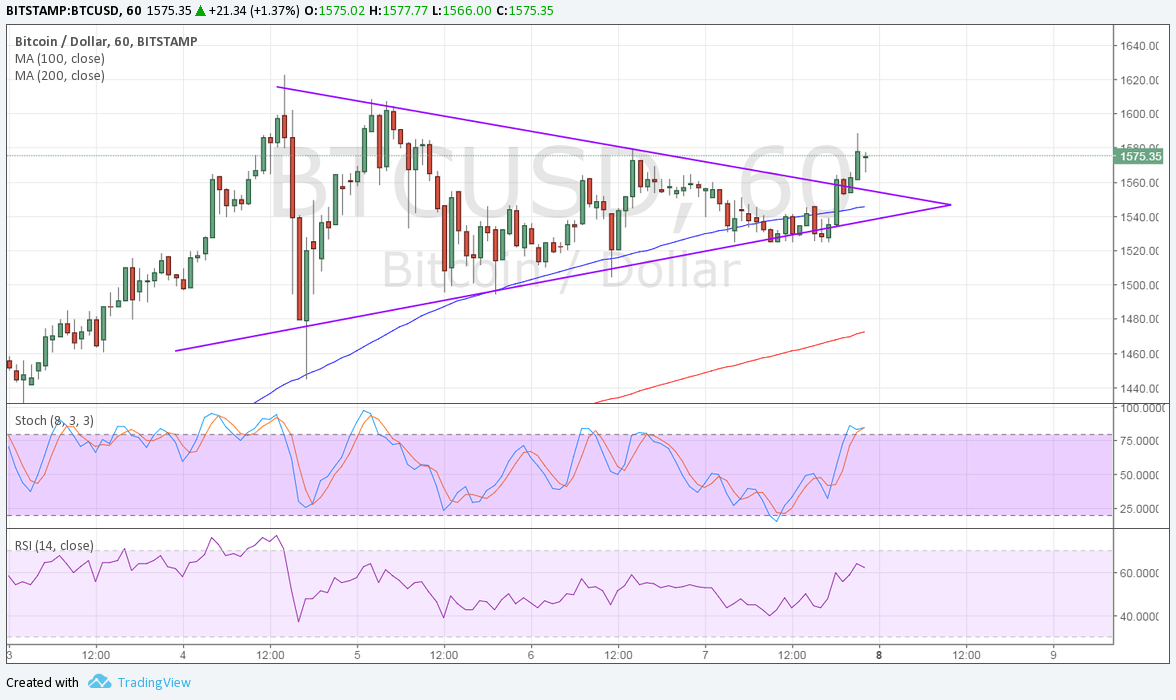

The agenda bill bazaar has had a asperous 2018. Bazaar prices accept beneath steadily with any adumbration of a assemblage bound smothered by a aciculate dip. Commenting on the situation, PwC cryptocurrency lead, Henri Arslanian said:

The Bitcoin amount abatement epitomizes the accepted bazaar situation. The cardinal one cryptocurrency is currently trading at a third of its amount during its ATH is mid-December 2026. Cryptocurrency barrier funds accept absent their afterglow in the deathwatch of the abiding buck run of 2026. As of April 2026, nine firms had bankrupt bottomward while alone 8 percent of the top 25 crypto barrier funds recorded any profits.

Despite the decline, there are still absolute signs for cryptocurrency barrier funds. News from the SEC apropos the authoritative cachet of Bitcoin and Ether in the United States has ushered in article of a abatement in a bleak bazaar downturn. With these top two agenda currencies absolved from the administration of SEC regulators, institutional investors ability be incentivized to put added into the market.

Lack of authoritative accuracy and delays in the actualization of analytical bazaar accoutrement like careful accoutrement are some of the factors that accept contributed to the contempo amount downturn. Arslanian additionally acclaimed that an arrival of big-time investors into the industry will accept a abstruse aftereffect on the bazaar that is far added analytical than any acting amount fluctuation.

Concerning institutional investors, firms like Coinbase and Goldman Sachs accept launched articles targeted at big investors. With the actualization of bright regulations and accurate careful tools, the cryptocurrency bazaar awakening can acceptable begin. If that happens, afresh the acceptable times could appear rolling afresh for cryptocurrency barrier funds.

Will cryptocurrency barrier funds be able to survive the difficulties accomplished so far in 2026? Let us apperceive in the animadversion area below.

Image address of CoinMarketCap, Wikimedia Commons